Last year I was critical of how I thought the Commonwealth Prac Payments were going to work. These were to provide Austudy level payments, currently equivalent to $331.65 a week, for nursing, midwifery, social work and teacher education students while undertaking compulsory work placements. The payment starts on 1 July 2025 for students on income support and some working students.

Rather late in the day, the legal paperwork for its higher education version was completed last week. The vocational education diploma of nursing version paperwork was already available. The higher education version is administered by universities and funded through the 'other grants' provisions of the Higher Education Support Act 2003. The VET Prac Payment is administered by the Department of Employment and Workplace Relations, although the funding is authorised under the Social Security Act 1991.

Things I was concerned about that have not happened

Some of my Prac Payment concerns from last year were not realised in the policy as enacted. The Prac Payment has a means test but it is based solely on the student's income, not family income. However family income has an indirect effect through eligibility for income support.

A policy goal is reduce the number of students who defer or withdraw from their course due to placement obligations, but students won't need to prove that they are considering either of those things.

But in the Australian way of public policy, the Prac Payment is an underwhelming half-measure. The payment is low and will be further reduced by tax and by social security income tests. Many students won't be eligible at all.

Who is eligible for the Prac Payment?

Aside from undertaking one of the compulsory placements, to be eligible students need to be a) on an eligible Commonwealth income support benefit or b) working with hours and income parameters defined by the guidelines. If working, a two-part test applies:

In either a) the 4 study weeks immediately prior to the mandatory placement starting or b) in the 4 study weeks immediately prior to applying for the Prac Payment (whichever is earlier) the student worked on average more than 15 hours a week (i.e. more than 60 hours over 4 weeks) AND

Earned from all sources less than $1500 a week on average (i.e. less than $6000 over 4 weeks).

Students on income support

All the eligible Commonwealth benefits – the plain-language list of which benefits are covered is in the vocational payment guidelines – are means tested. The ever-vigilant Services Australia is already warning students that they must declare Prac Payment income, which can reduce their income support payment. The government gives with one hand and takes with the other.

For students on Austudy the income test is fortnightly. Students can earn up to $528 a fortnight without affecting their Austudy payment. As the Prac Payment will pay $663.30 fortnightly it means the student's Austudy payment will be reduced.

For a single student with no children the Prac Payment would reduce their Austudy by $52.50 plus 60c cents per dollar over $633, so another $18.18 for a total of $70.68. The net value of the Prac Payment after the income test is $260.97.

Some students could use their income bank (credit for other fortnights in which they have earned less than $528) to reduce this impact. But if students earn other income from part-time work during their placement the income test would take more of their Prac Payment.

A better Prac Payment policy for students on income support might be to pay them exactly the income test amount – $528 a fortnight or $264 a week. The student would be $3 a week better off and the Department of Education would save $67.65 a week on each student.

For students on other income support payments the income test is less generous. For example, a student with one child on a Parenting Payment can earn $220.60 a fortnight before their payment starts decreasing by 40 cents in the dollar. Partial loss of the student's parenting payment would make the Prac Payment worth $243.11 a week.

Policy purpose - income support

The policy purpose for income support recipients seems slightly different from students facing the work test. Income support recipients won't lose any benefits income by doing their placement. But they are likely to incur additional expenses, such as travel to the placement location. This can include accommodation if the placement is too far from the student's home.

As described in the next section, for many working students the Prac Payment won't cover their income loss, let alone additional placement costs.

Students without income support - eligibility

The two-part test for working students without income support means that it only applies in a range of incomes. From 1 July 2025, when the new minimum wage of $24.95 an hour applies, 15.5 hours work (so more than 15 hours) = $386.72. So the Prac Payment is for students earning between $386.72 and $1499.99 a week. As the weekly Prac Payment is $331.65 students must lose at least $55 if they can't work their normal hours at all.

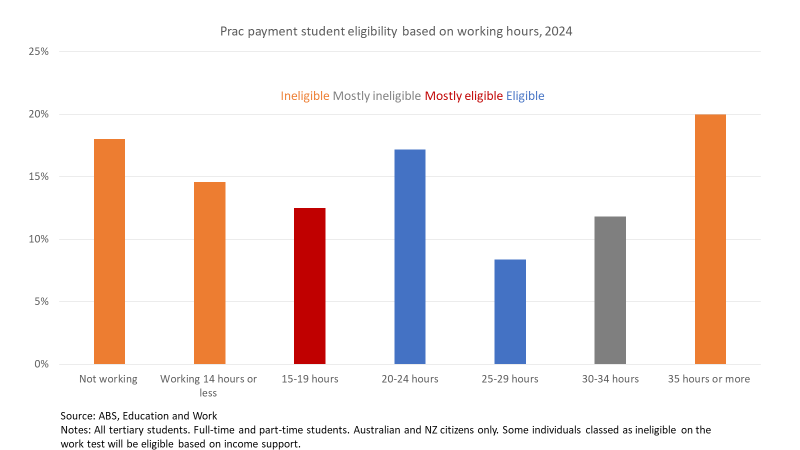

Using the ABS Education and Work TableBuilder product I can analyse the relevant fields of education, although this includes some courses that won't get the Prac Payment. The working hours options offered by TableBuilder don't exactly match the payment criteria, but based on Education and Work 2024 approximately 30% of students would be ineligible due to working too few hours, and another approximately 30% would be ineligible due to working too many hours (based on a minimum wage * hours calculation). Some no or short work hours students would, however, be eligible based on receiving an income support payment.

There is no taper in the Prac Payment. A person averaging $1499 a week gets the full $331.65 Prac Payment, a person averaging $1501 gets nothing; a person working 15.5 hours gets the full amount, a person working 14.5 hours gets nothing. We can expect gaming of the system to expand eligibility.

But with administration of the program outsourced to universities, discussed below, a tapered payment would have been unreasonably complex for organisations with no experience of running income support programs.

Policy purpose - income test

Other than to reduce the government's costs, I'm not clear on the rationale for the $1500 a week cut-off for Prac Payment eligibility. If the student is their household's main or a major income earner the financial consequences of taking time off for the placement are more serious than for students whose paid work finances discretionary expenses. The more than 15 hours minimum work makes more sense than the $1500 income maximum.

Admittedly $331.65 is not much compensation if the placement requires forgoing the full $1500+ a week; making the placement work is still going to require savings and sacrifices. But arguably a higher income signals greater rather than lesser needs.

The ATO takes its share

As well as counting towards social security income tests the Prac Payment is taxable. Somone on Austudy for 52 weeks would receive $17,245, just below the first income tax threshold of $18,200. Each course has its own maximum number of weeks on placement. It is 20 hours for nursing, so a maximum Prac Payment of $5219 (at the $260.97 effective rate, the money will be taken out of their Austudy), and total income support of $22,465. Of this, $4265 is taxable at 16 cents in the dollar = $682.

Someone at the upper limit of the income range would be in the 30 cents in the dollar tax bracket.

As the Prac Payment is taxable this reduces the effective cost of extending it to people earning over $1500 a week.

Deductible placement expenses?

While the ATO gets a cut of the Prac Payment money, as students are earning money for the placement can they claim placement expenses as tax deductions? I think probably not due to the interaction of section 26-19 of the Income Tax Assessment Act 1997 and section 160AAA of the Income Tax Assessment Act 1936, which refers to a 'Commonwealth education or training payment' (sub-section 1(b)). But sub-section 1 (b) cross-references a sub-section 6(1) for more detail, but that section does not seem to exist.

The role of Centrelink and the Department of Education

In 2024 I thought that Centrelink rather than universities should administer the Prac Payment. Universities aren't set up to run means tests. If all the casual underpayment issues are a guide, they aren't very good at ad hoc payments either.

During the Senate inquiry into the bill authorising higher education Prac Payment spending, however, students made a reasonably persuasive case that dealing with Centrelink was not easy, and that students not on income support currently have no interaction with the social security system. The universities would also still need to be involved, to authenticate that the placement was happening.

But arrangements for vocational education diploma of nursing students suggest a third option, that the relevant policy Department arrange the payments - the Department of Education for higher education students. If DEWR can do it so can the DofE, or better still they could share it. It would be more efficient than every university setting up its own means testing system, for which the Department has already paid them $2.3 million.

The relevant students could be flagged in TCSI, and records of the payments sent to Services Australia and the ATO for maximum efficiency and cost recovery.

Conclusion

The Prac Payment is a good idea, but with overly complex implementation that also reduces its value to students. Many students in Prac Payment courses will find that they are not eligible at all or, due to income tests and income tax, will get less than the already modest $331.65 a week. Some money is better than none at all, but these deficiencies raise questions about whether the Prac Payment will make a major difference to completion rates.