Are the government’s policies working to reduce international student numbers? Part 2, student visas granted

A previous post looked at demand from international students, as measured by student visa applications. By July 2024 all student deterrent policies announced to date were in place, so the last six months of 2024 could be used to assess initial policy impact.

That analysis found that demand for vocational education declined significantly, whether compared to 2023 or the more normal pre-COVID year of 2019. For higher education, demand was down on 2023. Compared to 2019, higher education demand in 2024 from migration-sensitive countries like India or Pakistan was well down, but demand from other important source countries increased or decreased only slightly.

Visa applications of course must be assessed by the Department of Home Affairs. Visas granted depend on visa processing levels and visa grant rates.

The visa grant analysis below is broadly consistent the first post's applications analysis. Visa applications and grants in 2024 were both down on 2023. However, 2024 visa applications were up on 2019 but visa grants were down, reflecting fewer applications being processed and lower approval rates.

For both visa applications and grants vocational education has been hit hard. Higher education is more resilient overall, with visa applications and grants both up on 2019.

Due to unprocessed applications and unresolved appeals against visa application rejections, not all 2024 applications have been finalised. These could result in 2025 visa grants that exceed expectations created by recent application levels.

Less clear links between cause and effect

Drawing straightish lines between policy changes and policy consequences is harder for visa grants than applications. Delays between visa applications and processing complicate the analysis. By mid-2024 Home Affairs had a huge backlog - over 113,000 unprocessed applications - including many received prior to 23 March 2024 when significant rule changes came into effect. Because some old rules apply to applications received before policy change dates, different criteria can be used in the same processing month.

Visa processing

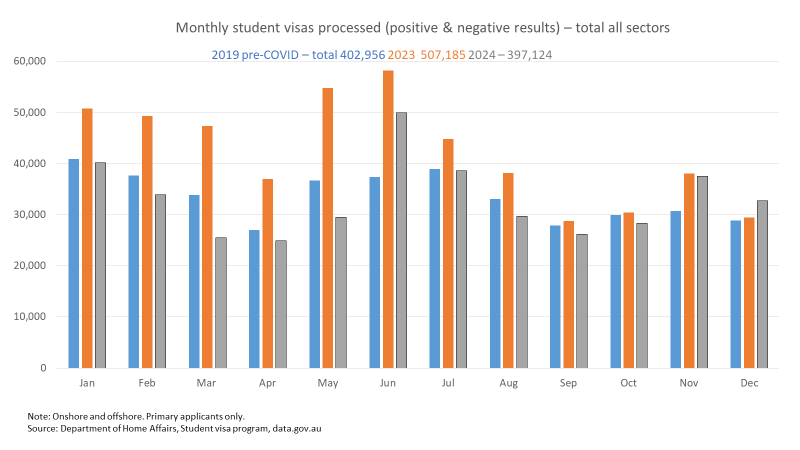

In the short to medium term, the visa backlog means that the number of visas granted depends on visa processing levels, and not just the flow of new applications discussed in my earlier post. In the chart below, we can see the February to May 2024 processing go-slow that contributed to the large 30 June backlog. From June 2024, monthly visa applications processed are more similar to 2019 levels.

Visas granted

A late 2024 boost in processing explains why more visas were granted in November and December 2024 than in either the 2023 boom year or pre-COVID year in 2019 (chart below). But for the whole 2024 calendar year, visas granted are down 24% on 2023 and 12% on 2019. This includes fewer grants in student visa categories not discussed in this post, the most significant of which is for English language courses.

Higher education

In line with the applications data, 2024 higher education visa grants were down on 2023 (-13%) but up on 2019 (+9%). The monthly data is a bit all over the place, but patterns of visa processing explain much of this.

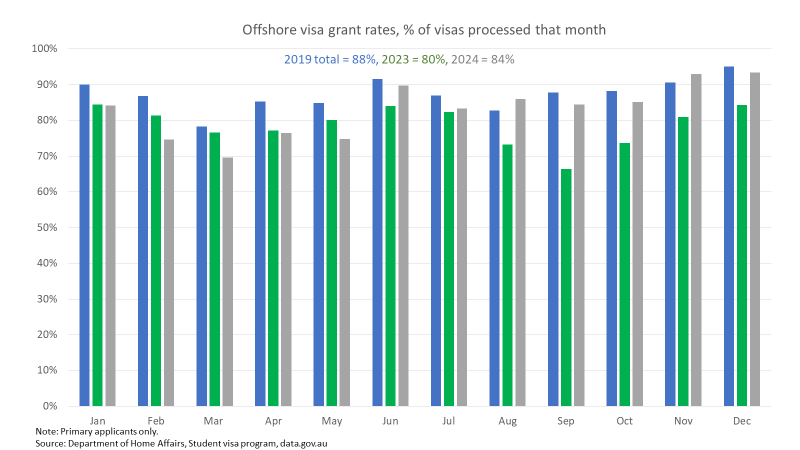

Although processing levels are a significant driver of higher education visa grants, from January to May 2024 visa grant rates were below previous levels. But from June 2024 grant rates improve - still generally below 2019 levels but above those recorded in 2023.

Speculatively, through late 2023 and early 2024 higher education providers and migration agents imcreased their understanding of how changed visa policy and practices affected chances of success. If so, they could more accurately filter out prospective students with high visa rejection risks. While the grant rate improved before the visa application fee more than doubled from 1 July 2024, that added expense may have made prospective students more cautious about submitting speculative applications.

As noted in the visa applications post, categories of students exempt from the commencing enrolment cap, along with packaged courses that lead to two commencements, complicate direct comparisons between visa data and the 'indicative' cap on commencing students. But putting the higher education data pieces together - reasonably strong demand in 2024 plus improving visa grant rates - a continuation of current trends would most likely see the indicative cap exceeded.

Vocational education

As expected given the decline in visa applications, vocational visa grants are well down on 2019 or 2023. The reduction is about 50%. Vocational visa grants in 2024 of 45,371 are less than half the indicative cap for 2025 commencing students.

Weak vocational education demand has been exacerbated low visa grant rates, only 54% for 2024, although with some improvement in November and December, possibly for the same reasons I suggested for higher education. Longer processing times for vocational compared to higher education could mean that it took longer for higher-quality applications to influence grant rates.

Onshore visa grants

As reported in the previous post, onshore visa applications in 2024 were above my 2019 and 2023 comparator years. Visa grants appear to tell a different story - down 37% on 2019 and 24% on 2023. Looking at month-by-month figures, the 2023 figures were inflated by big grant numbers January to May 2023, before the government changed its mind on international education. A processing go-slow from September 2023 then keeps monthly onshore grants down until June 2024. If we compare July-December only, 2024 numbers were slightly higher than in 2023 (+6%).

Onshore application visa processing increased in the second half of 2024 but the grant rate remains well down on the past.

Onshore student visa applicants can appeal against an adverse decision to the Administrative Review Tribunal (formerly the Administrative Appeals Tribunal). As the chart below shows, rejected student visa applicants are appealing in increasing numbers. At less than four months into the 2024-25 reporting year over 8,000 appeals had been lodged against a student visa refusal. This exceeds all the years between 2019-20 and 2022-23 counted together.

As of 13 October 2024, 18,227 student visa refusal cases were yet to be resolved. Of the 920 resolved cases in the July to October 2024 period, in just under half the tribunal set aside the original decision. If that apppeal success rate continues - it is above than the historical average - this will drive up onshore visa grants.

Offshore visa grants

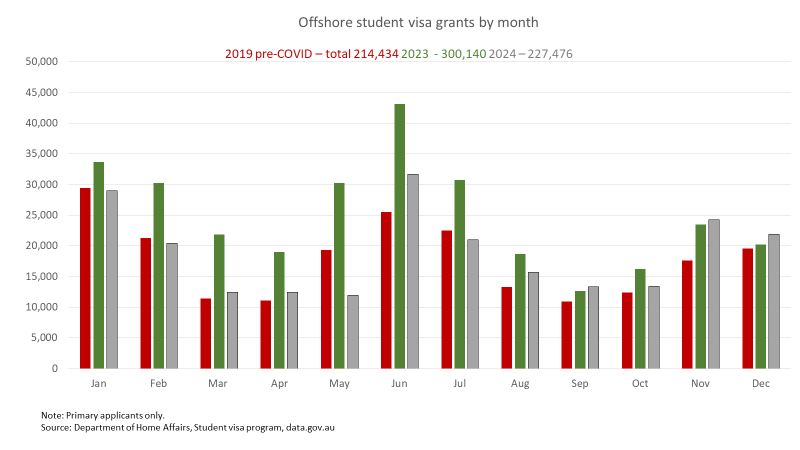

Offshore student visa grants in 2024 were down 24% on 2023. The government may be concerned that 2024 grants are up 6% on 2019 and exceeded 2019 levels in every month from August to December 2024. For higher education 2024 visa grants were 29% above 2019 levels.

Unlike for onshore visas, the offshore application visa grant rate returned to roughly 2019 levels from June 2024, after lower rates from August 2023 to May 2024. Higher education applications being a greater share of the total, along with improved understanding of how processing practices had changed, are likely reasons.

Source countries

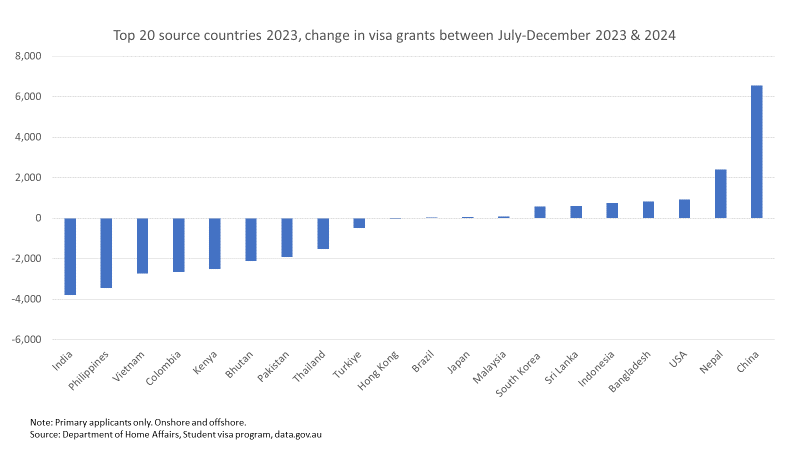

I haven't explored source country visa grant data in depth, but on a simple last 6 months of 2023 and 2024 comparison the results are mixed. While the top 20 source countries show a net decline, this was not uniform. The resilience of the Chinese market despite negative policy developments since 2020 is notable.

Conclusion

Visa grant data confirms that the pipeline of international vocational education students has been reduced to a trickle. The flow of higher education students remains, from the government's perspective, too high.

A significant uncertainty remains, however, due to unprocessed applications and rejection appeals. Despite visa applications processed exceeding new applications received in late 2024 a large backlog would still remain. On current ART appeal success rates this could also be a non-trivial source of new visa grants in 2025.

These factors combined could produce significant visa grants during 2025 even if 'voluntary' compliance with 'indicative' caps brings down the number of new applications received.